Fun Things To Do In Cambridge Ontario | 27 Of The Top Activities & Attractions

Searching for the best things to do in Cambridge Ontario? This charming city in Southwestern Ontario is a suitable day trip from Toronto and offers historical sights, outdoor activities, and breathtaking natural spaces.

The city falls within the Municipality of Waterloo and can be divided into three areas: Galt, Hespeler, and Preston. It is located on the meeting point of the Grand and Speed rivers, which helped to develop the milling, manufacturing, and brewing industries, still active today.

Read on as I dive into the top activities in Cambridge, Ontario, below. While you are in the area, consider my recommendations for things to do in Kitchener, things to do in Waterloo and things to do in St. Jacob’s.

This article is now available as a mobile app. Go to GPSmyCity to download the app for GPS-assisted travel directions to the attractions featured in this article.

History Of Cambridge, Ontario

Steeped in history, Cambridge, Ontario, is a city with a past as rich as its present. We’ll explore a bit more of Cambridge’s towns, Galt, Preston, Hespeler and Blair, a little later in the post.

- In the early 19th century, the Huron people had already established themselves in the region, with Chief Jean Baptiste Rousseaux and his family living on the banks of the Grand River. With the arrival of the Europeans, Jean Baptiste and his family moved further south. They developed a new settlement which would become the foundation of what we know today as Cambridge.

- Later, during the War of 1812, the area was a key battleground. Colonel William H. Smyth led a company of militia to Upper Canada and engaged in a battle led by Charles de Salaberry on November 4, 1813, which ended in a victory for the British forces.

- By 1816, the first settlers had arrived and began to lay down the roots of their colonial life. In 1824, Galt, Dumfries and Waterloo, which all makeup what we now know as the City of Cambridge, were all established. From there, the population began to grow, and a few years later, in 1851, the Town of Galt was officially incorporated.

- Throughout the early and mid-1800s, the city became a hub of activity for farmers, tradesmen, and entrepreneurs like notable businessman William Dickson who opened a successful paper mill known as the ‘Galt Paper Company’. Later, the Grand Trunk railway, built in 1856, serviced the area and made it an ideal destination for passengers and freight alike.

Getting To Cambridge

Cars

The distance from Cambridge is only 109 kilometres and takes about an hour and 40 minutes. Hop on the Gardiner Expy W and merge onto Queen Elizabeth Expressway. Pop onto the 403 W to Hwy 6 N in Hamilton then take exit 74.

Getting To Cambridge

West Galt Cambridge, Ontario Attractions

The weather is a significant factor when deciding what to do in Cambridge, Ontario. Many of the free things to do in this stunning city take place outdoors, making summer the most suitable time of year to visit.

Cambridge’s West Galt is an enchanting place to spend the day. Stop for a snack at one of the many local vendors or restaurants, or bring along a picnic to enjoy by the river. Take a stroll along the Grand River, which was once known as The River Ouse – including Mill Race Park, where the ruins of an 1840s mill are nestled among the scenic views.

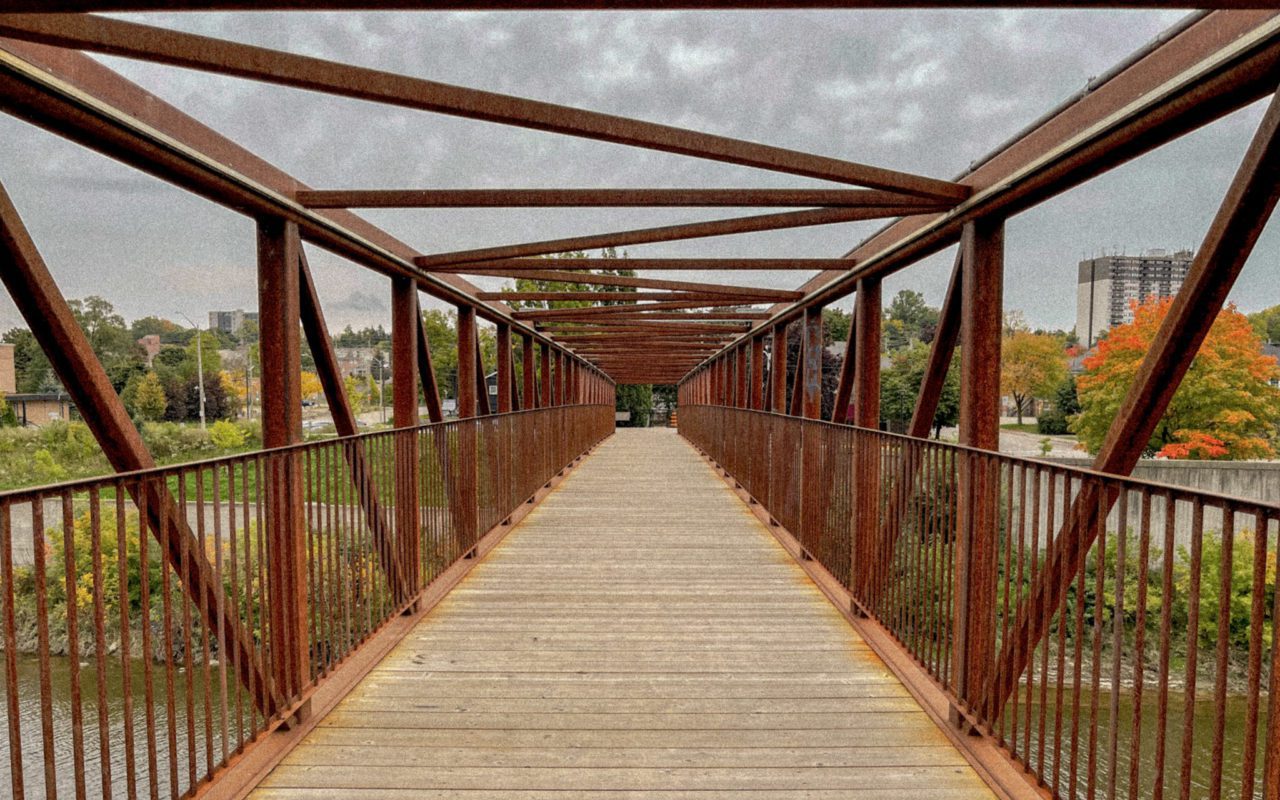

West Galt is connected to the rest of Galt via four main bridges, and the riverfront was also enhanced in 2018 with the addition of a pedestrian bridge.

In recent years, West Galt has become increasingly popular as a filming location – many of your favourite shows and movies, including The Handmaid’s Tale, have taken advantage of the beautiful backdrop. Some of the toughest scenes to take in, especially the ones involving bodies of protesters hung up on a brick wall, are filmed in the nearby cities of Cambridge and Galt.

The following attractions in West Galt are available all year round.

Hamilton Family Theatre

Situated in the historic downtown area of Cambridge is the stunning Hamilton Family Theatre. This state-of-the-art facility hosts musicals and plays and is the perfect two or three-hour activity. The theatre’s acoustics are world-class, and the seating offers an intimate experience for up to five hundred guests.

Idea Exchange Old Post Office

The award-winning project at the Old Post Office is worth a visit. Idea Exchange offers a place for creatives to tinker, draw, fabricate, and build. The striking building includes a makerspace and creative studio where members can use the tools and services.

Idea Exchange Queen’s Square

The Idea Exchange Queen’s Square is a public library with a growing collection of contemporary art on exhibition in its gallery. As a member, you will have access to the library, community garden, and even tools to use in your garden.

Queens Square Fountain

You can experience the beauty and tranquillity of downtown by visiting Queens Square and the fountain. Its picturesque stroll across the old bridge brings you to this serene and inviting spot where you can enjoy a picnic or coffee from Melville Cafe or Grand Cafe and people-watch.

Cambridge Sculpture Garden

While there are only a handful of sculptures, they are brilliant and will stimulate your creativity. A 130-year-old oak tree and stunning scenery in the Cambridge Sculpture Garden make it worth visiting. The garden is in the heart of the city and offers a free and fun thing to do.

Barnacle Bills

If you’re a fan of fish and chips, you’ll love Barnacle Bills! Voted the best restaurant in Cambridge for fish and chips, it’s a cozy and family-run business located right on the banks of the Grand River. Not only can you enjoy a delicious meal, but you can also take a walk down the river, ending your evening in the downtown core!

McDougall Cottage Historic Site

The McDougall Cottage was built in 1835 and celebrates Cambridge’s Scottish heritage. The cottage is now an interpretation centre and a wonderful tribute to Scottish stone masonry. The granite and dolomite limestone blocks are typical of the cottages built in Galt in the 1800s.

The century-old mural and furnishings transport you back in time to give you a glimpse into the 1800s.

Trinity Anglican Church

As the oldest stone church in the Waterloo Region, you’ll want to see the ornate stained glass at the Trinity Anglican Church for yourself. It continues to be a positive influence on the community of Galt, with weekly services and a food outreach for the needy.

Visit the Trinity Park next door for a chance to relax and contemplate your travels while walking the labyrinth.

Central Presbyterian Church

The Central Presbyterian Church is breathtaking in appearance and is located along the Grand River. It is a sight to see, with gothic-style architecture and a towering spire. For the best view of the church, walk along the Cambridge Main Street Bridge. If you would like to join for worship, visit on a Sunday at 10:00 or watch online.

Interestingly, the church’s bell was shipped from Scotland.

Grace Bible Church

Located in downtown Galt on Grand Avenue, this central church is beautiful on the inside and outside. Find a seat in the gallery to take part in a Sunday sermon. From here you can admire the organ and tall stained-glass windows. It is a magnificent venue and is often host to performances by the Cambridge Symphony Orchestra.

C’est Cheese Please!

This fine cheese and gourmet food store in the heart of Cambridge is the perfect place to pick up supplies for an afternoon picnic. The owner sources cheese from Canada and around the world to provide you with an excellent selection.

Consider a carefully curated cheese basket for a palate-pleasing experience.

East Galt Cambridge, Ontario

While Ontario offers exhilarating activities like ziplining at Niagara Falls, Cambridge is a more relaxing destination. East Galt is home to many restaurants, live music venues, and things to do.

Cambridge City Hall

The Cambridge City Hall sits alongside the historic Galt City Hall and the Fire Hall Museum. The area is worth visiting on foot for the architecture alone. The Cambridge Centre for the Arts is next door and offers classes and events.

Mill Race Park

Head to Mill Race Park in the town centre for a quiet spot to take a breath and soak in the scenery. While this park is small, it is set along the Grand River and features the remains of an 1847 mill. Bring your camera to make the most of the scenic spot.

Reid’s Candy & Nut Shop

Once an adorable mom-and-pop nut shop founded in 1935, Reid’s Candy & Nut Shop is still just as beloved as ever. Now a candy and nut paradise, this store is famous for its creamy and delicious chocolates. Reid’s has something for all your sweetest cravings – from candy apples and nuts to mouthwatering chocolates.

Shop at Cambridge Farmers’ Market

The Cambridge Farmers’ market is a great place to visit in East Galt on the corner of Dickson and Ainslie street. It has offered crafts and food since 1830 and is open for trading on Saturdays from 7 am to 1 pm and on holidays. Are you looking for more fresh produce? Try the Hespeler Village Market.

Cambridge Main Street Bridge

Since 1931, this bowstring arch bridge in the city’s centre has connected West Galt to East Galt. Consider walking across the bridge on the 8-foot wide sidewalks for an attractive vantage point above the Grand River.

Cambridge Mill

Sit down for a delicious wood-fired pizza at this restaurant located in a renovated 19th-century mill. The food is delicious, and the venue offers riverside views with a relaxing atmosphere.

Wesley United Church

The Wesley Methodist Church in Cambridge was first organized in 1853 and opened into its current form in 1884. This congregation is proud to be the first church to broadcast sermons over the radio, a practice it still takes part in today.

If you are lucky, you can get a freshly baked apple dumpling on a Saturday made by volunteers in the Church basement.

Galt Collegiate Institute

Known by many as the castle on the river, the home of the Galt Ghosts is something to marvel at. Having been established in 1852, G.C.I. is one of Ontario’s oldest still operating high schools. It is also a historic site recognized by the Ontario Archaeological and Historic Sites board.

As Galt Collegiate Institute has such an illustrious past, many believe it is haunted. It is worth visiting this remarkable historical landmark; you may even witness a ghost!

Hespeler Cambridge, Ontario

Hespeler is the most northeasterly section of Cambridge. Soak in the views of the Speed River before taking a step back in time at the museum. Below are our suggestions of things to do:

Fashion History Museum

This non-profit museum is located in the former post office, built in an art deco style in 1928. The exhibit and building do well to transport you back in time.

The Fashion History Museum is suitable for all ages and includes entertaining digital presentations. Through a story including 8000 garments, you will leave with a deeper understanding of fashion history. Adults can expect to pay $12 upon entry, while children under 18 enter for free.

Four Fathers Brewing Co.

Four Fathers Brewing Co serves excellent burgers and even better beer if you are in Hespeler and need a bite to eat. If you have pleasant weather during your visit, try the 9-hole disc golf.

Hespeler Village Market

Dedicated to the farm-to-table movement, this village market in Hespeler offers fresh, locally-grown produce. Alongside delicious treats, you can expect to find crafts from local artisans. The market is seasonal, taking place between June and October, and opens on Fridays from 15:00 to 19:00.

Mill Run Trail

The Mill Run Trail spans Riverside Park to Mill Pond in Hespeler and offers a long route for walking, biking, and running. In addition, it’s stroller-friendly and perfect for bringing your pet or family for a family outing.

Whether for a leisurely stroll or a longer trek, the Mill Run Trail is a beautiful trail to explore.

Things To Do Near Cambridge, Ontario

The following activities take place slightly further out of the city. They are easily accessible within half an hour by car.

Cambridge Butterfly Conservatory

Butterflies are charming and incredibly diverse insects. The Cambridge Butterfly Conservatory offers you the opportunity to see around two thousand butterflies fluttering in the 10,800 square foot indoor tropical garden.

Learn about incredible insects and the metamorphosis journey from caterpillar to butterfly. The conservatory is suitable for all ages, and the café offers delicious coffee and cake.

Spa at Langdon Hall Country House Hotel

You deserve a relaxing place to rest your head after a day of attractions in Cambridge. Settle in for a spa treatment and an exquisite night’s stay in this luxury hotel. The building exudes style and features tranquil gardens.

The Grand Trunk Trail

For those looking to enjoy the Grand River in a different way, The Grand Trunk Trail on the south shore of the Grand has plenty to offer. Immerse yourself in nature and explore the beauty of the serene forest path with a 10km return trip. Take in the sounds of the birds and read up on the informative posts located along the trail.

Shade’s Mills Conservation Area

Shade’s Mills is a great place to enjoy nature and the outdoors near Cambridge. Here you can relax on the water’s edge, swim, fish, or hike the forested trail. Best of all, dogs are welcome when kept on a leash.

In summer, hike on the paths beneath the hardwood trees in the forest, winding along Mill Creek. Afterwards, try fishing in the 32-hectare reservoir to catch northern pike, perch, and bass.

Sheave Tower

Nestled in the lush greenery of the Carolinian forest, on the edge of Cambridge is the small town of Blair. In addition to some great hiking trails you’ll find the Sheave Tower, a hidden gem to be discovered by tourists and local citizens alike.

This historical building is the oldest hydroelectric site in Ontario. It provided power to the nearby Carlisle Grist Mill in a fashion seldom seen today. The tower harnessed the creek’s energy with a water turbine and helped increase the mill’s power via a metal cable.

While the historic Blair Sheave Tower is surrounded by trees in an other-worldly setting, it is only meters away from the road.

Learn About the History of Cambridge, Ontario

Learning about Cambridge, Ontario’s history is an added bonus to the sightseeing in the area. The city of Cambridge, as mentioned above, is the consolidation of the city of Galt, the Towns of Preston and Hespeler, and the community of Blair.

Following the amalgamation in 1973, the city has continued to preserve the rich history of each area. This pride is showcased in the way the residents use the old names to describe where they live. Discover a little more about each area below.

Galt, Ontario

Galt is in the centre of Cambridge and was founded in 1816 at the meeting point of Mills Creek and Grand River. It was originally a settlement of predominantly Scottish immigrants and soon became large enough to need a post office. The name Galt was chosen for the settlement in honour of the Scottish novelist and Commissioner of the Canada Company, John Galt.

It grew to become the largest community in the area by serving the needs of the surrounding farmers. By the late 1830s, Galt had developed into an industrial powerhouse with a reputation for manufacturing high-quality products.

Preston

German-speaking Mennonites from Pennsylvania settled along the Speed River in 1806. The Grist Mill industrial building on Kings Street amongst others brought growth to the area. Labourers moved to Preston to work in milling, textiles, and lumber industries. The gristmill played a role in the town’s development and is now a commercial building with a bakery.

If you are ready to relax, soak in one of the natural sulphur springs. They provide the perfect water for Preston’s numerous spas and health resorts.

Hespeler

Jacob Hespeler, after whom the town was named, purchased 145 acres of land along the Speed River in 1845. The textile mill he started in 1862 played a pivotal role in the area’s development. The small New Hope settlement soon developed into an industrial complex and was at one point home to the largest textile producer in the British Empire.

The Dominion Woollens and Worsteds textile company began on the old mill site in 1928. Young women were recruited during a shortage of workers in the early 1940s due to the war efforts overseas. Affectionately known as ‘Mill Girls’, these women helped keep the production line moving.

Blair

The village of Blair formed after the creation of a dam and flour mill on Bowman Creek in the early 1800s. At the western edge of current-day Cambridge lies the small town of Blair where you will find trails winding through the rare Carolinian forest and historic monuments like the Sheave Tower.

This beautiful village’s history is celebrated in the appearance of Sheave Tower in the City of Cambridge’s flag. Near to Sheave Tower on Old Mill Road, you can visit one of the oldest European cemeteries in the Waterloo Region.

Cambridge Accommodations & Map

Great Things To Do In Cambridge, Ontario

There are many fun things to do in Cambridge, Ontario, with historic farmers’ markets, great outdoor spaces, and attractive river views. While nearby cities offer more exhilarating activities, this town is ideal for a quieter weekend away.

If you enjoyed the above places in Cambridge, consider the markets and things to do in Brantford.